282 Calgary Trail NW, Edmonton, Alberta

P: 780-439-7000

F: 866-293-5424

Buying Investment Properties

Why Real Estate vs. Stocks or Mutual Funds?

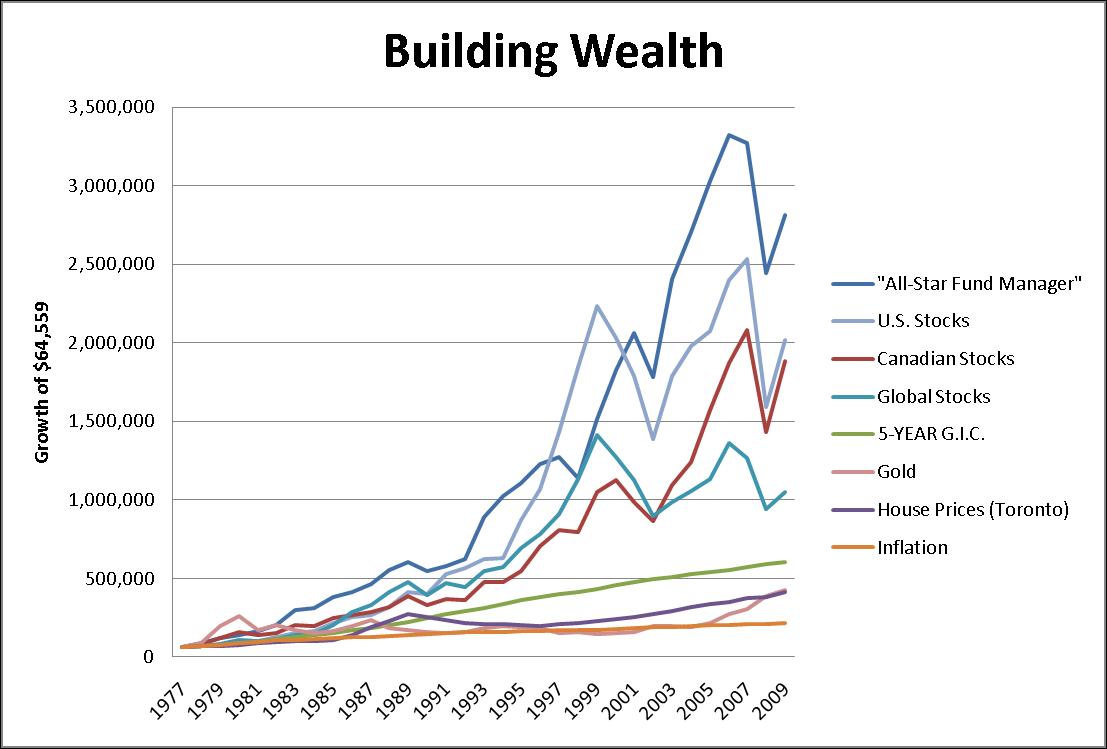

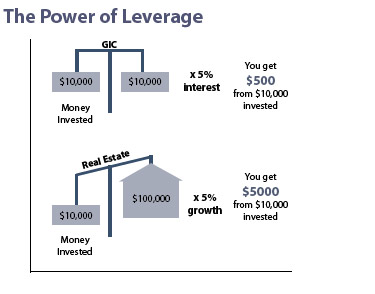

How have your stocks and mutual funds been performing over the last few years? Well, we have seen an average over 10% annual appreciation on the equity of real estate, equalling a minimum effective 20-40% annual effective rate of return on investment (ROI) with leverage since 2000 (see below for explanation). Most stock brokers or investment representatives will show you charts like the one below as to how they outperform real estate, but it doesn't take into account the effect of leverage. If you have $50,000 to invest, you can own $50,000 (less any upfront fees) of a stock or equity investment, or you can own a conservatively $200,000 real estate asset (assumes 25% down). If markets rise by 5%, you'll get $2500 on your stock investment and $10,000 on your real estate investment. Which do you think is better for your goals?

General Information on Real Estate Investing:

Whether you are just getting started or you already own a portfolio of properties, we understand your goals and can work with you to achieve them. Real Estate investing has many advantages over other types of investments, but it is not for everyone. Our Edmonton and Alberta market has been growing very strongly over the past few years and is predicted to continue over the next few as well. That being said, the main advantages of real estate investing are in the longer term, that being over five years. The main advantages of this type of investment over other investment vehicles are:

-

Leveraged appreciation - your assets growth is multiplied *

-

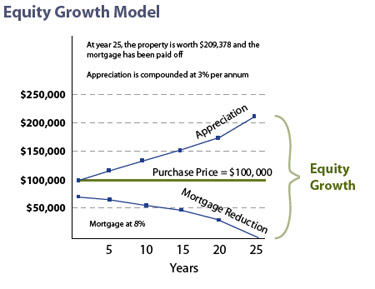

Equity repayment - tenants pay down your mortgage for you.*

-

Tax advantages - save now and later, refinance tax free.

-

-

Cash on cash rental return - generate a monthly cash income.

-

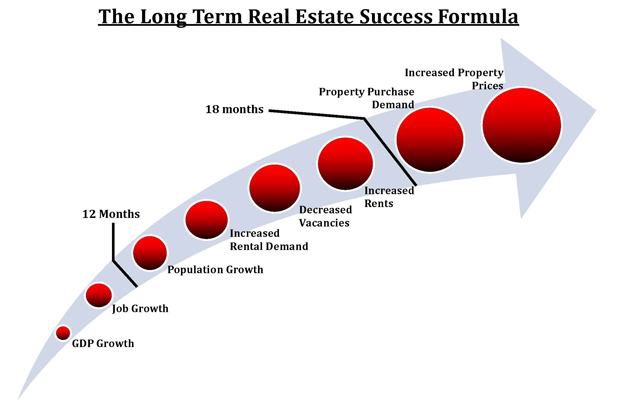

How to predict the future - Research provided by Real Estate Investment Network™ & www.donrcampbell.com

* Charts in points 1 & 2 above are referenced from www.ppgcorp.ca an extremely sucessful client of ours

Successful Property Management

In addition to that, the key to optimizing your investment is good management of the property. Depending on your skill set, time available, size of property, and resources available, management can take on many different forms. One of the first things we do with all clients is what we call a risk tolerance and situational analysis to determine what type of property would be best suited for you to invest in or how to best optimize your current portfolio. Once you have made the decision to sell and we think the timing is right the next step is to maximize the current market value for the sale. There are many ways of accomplishing this, and our experience and results have proven very successful to maximize your property values. We would be happy to meet with you to discuss your situation further. Please feel free to contact us to discuss your particular situation. You can also access any of the following services available below:

What next?

- See our latest Preferred Investment Opportunities

- Property Finder – let us know what it is you are looking for, and we will look for you and contact you with available properties.

- Search for Property – feel free to search the entire MLS* and let us know of any properties your interested in.

- Attend one of our upcoming seminars

- Sign up for our Free Newsletter to keep informed on the market and upcoming seminars.